New Year. New Ledger. No Excuses. The January Business & Tax Readiness Checklist

- Shaylah Kiser

- Jan 5

- 3 min read

By Kiser’s Legal Support Solutions

The confetti has settled.

The vision boards are up.

And the inbox is already loud.

Now comes the real beginning-of-the-year work—the kind that doesn’t get applause but keeps your business legitimate, defensible, and profitable.

January isn’t about vibes.

It’s about compliance, clarity, and control.

Let’s set the table properly.

Why January Is Non-Negotiable

January is your corporate reset. What you organize now determines:

Whether tax season is smooth or stressful

Whether your CPA can advise—or has to untangle

Whether your business looks polished or precarious

The IRS doesn’t care how small you are.

They care how accurate you are.

PART I: The Beginning-of-Year Business Checklist

1️⃣ Verify Your Business Identity (Before You Touch Taxes)

Start with the fundamentals:

Legal business name (exactly as registered)

EIN confirmation letter

Entity type (LLC, S-Corp, C-Corp, sole proprietor)

Active state registration

Current business address, phone, and email

If this information doesn’t match across platforms, filings get delayed—or flagged.

2️⃣ Review Prior-Year Financials (Not Perfect—Just Honest)

You don’t need final numbers yet, but you do need visibility:

Profit & Loss statement

Business bank statements

Business credit card statements

Outstanding invoices

Vendor payment summaries

This is where errors surface early—before penalties do.

PART II: Payroll & Contractor Reporting

Get Those W-2s and 1099s OUT

Deadlines live here. Handle this part cleanly.

Employees → W-2 Forms

If you had employees:

W-2s must be furnished to employees by January 31

W-2s must also be filed with the Social Security Administration by that deadline

If January 31 falls on a weekend or federal holiday, the deadline moves to the next business day

Before issuing:

Confirm legal names

Confirm Social Security numbers

Confirm wages and withholdings

Late W-2s = fines. No debate.

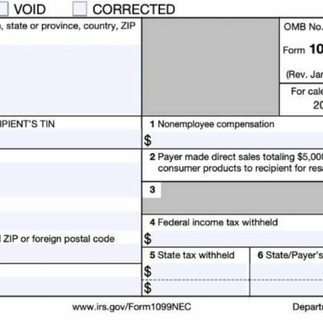

Contractors → 1099-NEC Forms

If you paid contractors:

1099-NEC applies if you paid $600 or more for services

Forms must be:

Furnished to the contractor by January 31

Filed with the IRS by January 31 (paper or electronic)

Before issuing:

Ensure a completed W-9 is on file

Confirm name, address, and EIN/SSN

Confirm total payments

Important nuance:

Many payments to corporations are exempt—but key exceptions exist (including certain legal and medical payments). When in doubt, verify before assuming.

PART III: Your Tax-Ready Document Stack

Create one master folder—digital or physical—and include:

Core Business Records

Prior-year tax return

EIN letter

Articles of Organization / Incorporation

Operating Agreement or Corporate Bylaws

State and local licenses

Income Documentation

1099s received

Client payment summaries

Platform reports (Stripe, PayPal, Square, etc.)

Expense Documentation

Receipts

Mileage logs

Home office records

Equipment purchases

Software subscriptions

Professional fees

If it isn’t documented, it isn’t deducted.

PART IV: January Compliance Power Moves

✔ Reconcile Your Books

Close out December properly. Don’t drag last year’s mess into this year’s ledger.

✔ Update Vendor Records

Missing W-9s get fixed now—not later.

✔ Schedule Your Tax Professional Early

The good ones book fast. Waiting limits strategy.

✔ Review Estimated Tax Obligations

Confirm quarterly payments early to avoid surprises.

Straight Talk (Because It’s Needed)

The IRS doesn’t care if you were busy.

They don’t care if you’re learning.

They care if your paperwork is right.

Organization isn’t optional.

It’s a business requirement.

How Kiser’s Legal Support Solutions Supports You

While we do not provide legal or tax advice, we support professionals by:

Organizing compliance-ready documentation

Structuring records for CPAs and accountants

Supporting payroll and reporting workflows

Helping businesses start the year clean, credible, and confident

Professionalism shows up on paper first.

Bottom Line

January isn’t about hustle.

It’s about infrastructure.

Get the W-2s out.

Get the 1099s issued.

Get your documents aligned.

Run your business like it plans to be here next year.

Kiser’s Legal Support Solutions

Professional support behind the record—and behind your business.

Comments